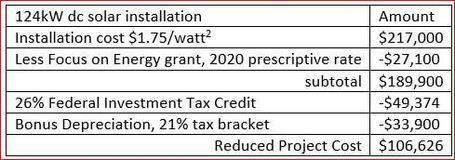

Third Party Participants (TPP) are legal entities, usually structured as limited liability corporations (LLC), who provide a means to monetize the Federal Investment Tax Credit (ITC) and provide a financing mechanism for site owners who want to install renewable energy on their premises. This arrangement provides upfront capital as well as reduced costs. I will try to explain why TTP are important to Wisconsin’s clean energy future. Commercial PV projects are economically feasible because of the decline in solar prices combined with Federal and State incentives. Installation costs are typically 60% below a decade ago. Wisconsin’s Focus on Energy RECIP program has reduced upfront costs by as much as 34% in 2019, but proposed changes in 2020 will eliminate the RECIP program for solar PV and be replaced by a Prescriptive Incentive which will reduce costs on a tiered schedule by, in general, about 12%. In addition, the Federal investment tax credit (ITC) plus bonus depreciation can reduce costs by another 41-50%[1]. This table represents a hypothetical example of a 2020 solar PV project owned by a business. 124kW dc (100kW ac) is used because it is Xcel Energy’s net metering limit. This installation would generate about 147,000kWh annually and the value of the electricity generated at a commercial General Service TOD rate is about $10,700 per year. This is a conservative estimate and does not include demand charge reduction which will vary by site, depending on energy usage patterns. Simple payback would be 10 years or if money is borrowed the value of the electricity generated would exceed the payments on a 20-year note at 4% interest by $1500 the first year, making it cash flow positive. This example is used to demonstrate how essential each component is to make a project financially viable. Municipalities, school districts and non-profits, however, cannot directly take advantage of the ITC and depreciation expense because they do not pay Federal income tax. Likewise, a business may not have the capital, or it may not be the best use of a business’ limited capital to invest in a solar project. To compensate, many states allow Third Party Participants (TPP), who own or co-own a solar installation for a minimum of 6 years, and use the tax credits, passing some of the savings on to a non-tax-paying entity. TTP can also provide upfront capital to any business or residence and could pass savings on to customers that might not have an adequate tax liability. TPP typically use the PV system as collateral to secure the financial arrangement, unlike banks who typically use real estate to collateralize a loan. TPP, therefore, have advantages in securing needed capital. Wisconsin is not one of those states allowing TPP and instead uses 1912 utility law as governance. The utility’s legal argument is that they are guaranteed a monopoly by law and the TPP is infringing on their territory and acting as a utility. The TPP’s argument is that they are not offering a service to the public, but rather are engaging with a single entity, and are providing a financing mechanism. The WI Public Service Commission has refused to take up this issue, deferring instead to the Wisconsin legislature. Without the ITC, coupled with the reduced rate of Focus on Energy funding, most municipal, school district and non-profit solar PV projects are no longer financially feasible in Wisconsin. Wisconsin’s legislators need to re-examine why they cannot move past 1912 utility law and find an equitable solution. Not all utilities are opposed to TPP. Bayfield Electric Cooperative and Dairyland Power Cooperative are supporting a TTP project in northern WI. Xcel Energy states that their hands are tied and it is ultimately not their decision. As of 2018, 26 States and the District of Columbia have adopted policies that include TPP.[3] Wisconsin is lagging behind in solar deployment because of an antiquated policy. TPP is a market-based solution providing necessary capital and savings for renewable energy projects. Upfront capital is needed for any project, whether it be a municipality, business or a residence. Using TPP leaves limited capital resources with the customer where they can do the most good. It seems clear, at least to me, that many investment-owned utilities are using the monopoly law as an excuse to rationalize not allowing TPP. In reality, they seem to be more concerned about the reduced income that customer-sited solar PV represents. This logic is based on fear, not statistics. Currently, customer-based solar penetration is a small fraction of energy generation and subsequently insignificant on a large utility's bottom line. Our local governments and schools are being disadvantaged because of this ill-conceived logic and our businesses and residences have restricted capital available to them. This will likely end up in the WI Supreme Court, but it shouldn’t be their decision either. The current law is limiting solar deployment in our schools, local governments and non-profits, as well as our businesses and residences, the grass-root entities that should be leading our clean energy future. It's time for the Wisconsin legislator to step up to the plate and pass clean energy policy that includes TPP. Bill Bailey Cheq Bay Renewables [1] ITC scheduled to be 26% in 2020 unless Congress extends tax credits. Bonus depreciation is based on income tax rates. [2] Price of recently installed municipal projects in Washburn, WI [3] Institute for Local Self Reliance: https://ilsr.org/states-agree-third-party-ownership-enables-distributed-solar-but-whats-next/

0 Comments

Leave a Reply. |

Author: Bill BaileyCheq Bay Renewables Archives

May 2021

Categories |

RSS Feed

RSS Feed